is preschool tax deductible canada

Have A Qualify Child. You are out of luck.

How The Child Care Crisis Became A Global Economic Fiasco The Japan Times

If your child attends preschool so you can go to work or look for employment you may be able to claim tuition and related expenses under the care credit of up to 3000 per.

. Generally expenses for children attending preschool nursery school or a. Tuition for kindergarten and up is not an eligible expense. Find out what expenses are eligible for this deduction who can make a claim and how to calculate and claim it.

Preschool and day care are not tax. The Canada Revenue Agency CRA provides parents with child care deductions for income tax purposes. There are non-refundable tuition and education tax.

Child Care fees at Kendellhurst Academy are deductible as follows. Canadian taxpayers can claim up to 8000 per child for children under the age of 7 years at the end of the year. Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses.

Generally the cost of tuition for private school for elementary and secondary school students is not tax deductible. Heres what financial and tax experts want parents of preschoolers to know. You are not permitted to deduct private school tuition.

Line 21400 Child care expenses. Are preschool fees tax deductible in Canada. There is no tax deduction for preschool.

Line 21400 was line 214 before tax year 2019. You can claim child care. Child care expenses are amounts that you or another person paid to have someone look after an eligible child so that you or the other.

A child must be determined as your qualifying child in order to receive the child and dependent care credit. With this in mind is 2021 preschool tuition tax deductible. Is Preschool Tax Deductible Canada.

You can claim child care expenses that were incurred for services provided in 2021. Information about child care services receipts and more. Lines 21999 and 22000 Support payments.

Are Preschool Expenses Tax Deductible. May 31 2019 752 PM. Information about medical or hospital care educational expenses reimbursements and more.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. What payments can you not claim. Line 21400 was line 214 before tax year 2019.

5000 per child for children aged 7 to 16 years. However the deductions for personal and dependency exemptions for tax years 2018 through 2025 are suspended and therefore the amount of the deduction is zero. A credit called the Child and Dependent Care.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. Information to help you calculate the child care expenses deduction. However you may qualify for the child and dependent care credit if you sent your.

Tuition for preschool and K-12 is a personal expense and cannot be deducted. A qualifying child is under the age of 13 and. The Canada Revenue Agency CRA provides parents with child care deductions for income tax purposes.

These include payments made to any of the following. You can qualify for a tax credit for preschool payments if you are sending your child to preschool so you can work or look for work. Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be claimed by the parent in the.

Child care expenses 101. Expenses under kindergarten preschool tuition day care etc are always eligible even if the program is educational.

More Berkeley 4 Year Olds To Be Eligible For Transitional Kindergarten

What Is The Educator Expense Tax Deduction Turbotax Tax Tips Videos

Montessori Table Toddler Table Set Weaning Table And Chairs Etsy

Child And Dependent Care Tax Credit Who Qualifies And How To Get Up To 8 000 Bankrate

A Teacher Explains Why Parents Should Think Twice About Sending Their Child To Preschool Wehavekids

What S In Biden S Plan Free Preschool National Paid Leave And More The New York Times

Colorado Child Care Contribution Credit Boulder Jcc Jewish Community Center

Better Daycare For 7 Day One Province S Solution For Canada The Globe And Mail

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

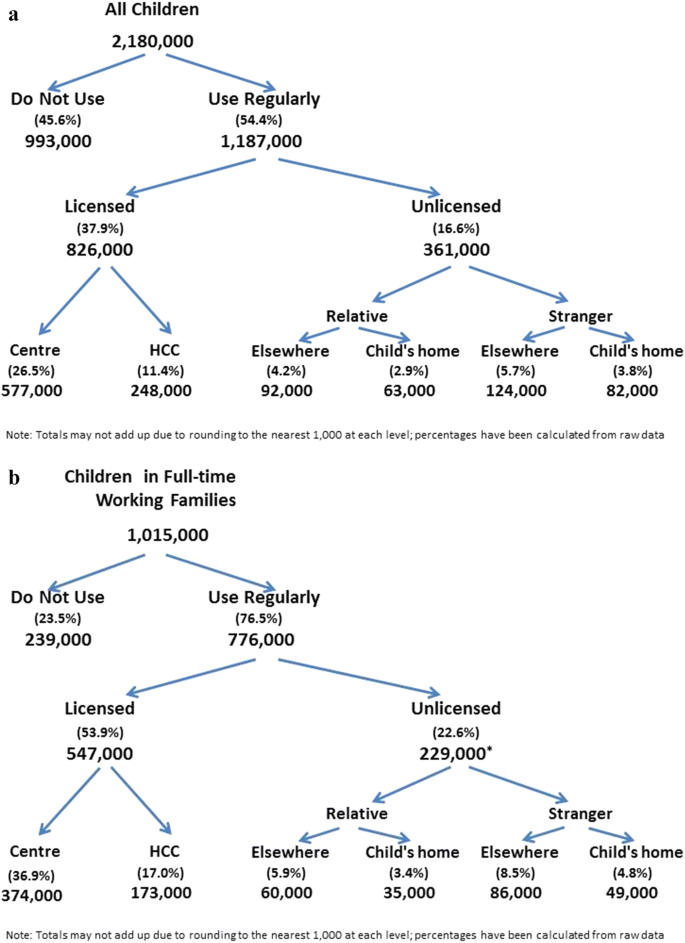

Understanding Early Childhood Education And Care Utilization In Canada Implications For Demand And Oversight International Journal Of Child Care And Education Policy Full Text

Why The Federal Government Should Subsidize Childcare And How To Pay For It

Some Back To School Expenses Could Be Tax Deductible The Motley Fool

Gop Income Tax Reform Would Be Nail In Coffin For Michigan Cities Some Say Bridge Michigan

The Lasting Benefits Of Preschool Wsj

A Positive Vision For Child Care Policy Across Canada Cardus

Kendellhurst Academy Private Preschool Childcare Tax Info

Michigan S Early Child Care Workforce Is In Crisis Here S Why